Budget Insurance Review

Quick overview

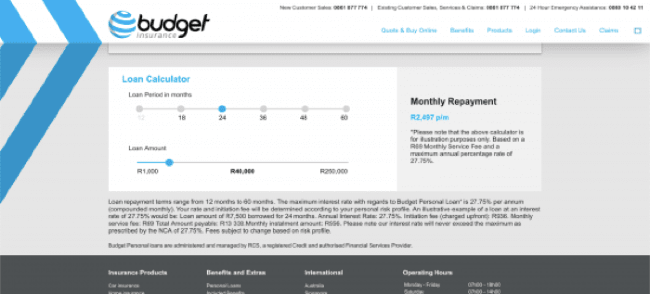

- Amount: R1.000 - R250.000

- Term: 12 - 60 months

Budget Insurance table of repayments

| Amount | Fee | Total payment | Term |

| R1.000 | R1.628 | R2.628 | 18 months |

| R30.000 | R12.012 | R42.012 | 18 months |

| R40.000 | R19.928 | R59.928 | 24 months |

A representative example

Loan repayment terms range from 12 months to 60 months. The maximum interest rate with regards to Budget Personal Loan* is 27.75% per annum (compounded monthly). Your rate and initiation fee will be determined according to your personal risk profile. An illustrative example of a loan at an interest rate of 27.75% would be: Loan amount of R7,500 borrowed for 24 months. Annual Interest Rate: 27.75%. Initiation fee (charged upfront): R936. Monthly service fee: R69 Total Amount payable: R13 338.Monthly instalment amount: R556. Please note our interest rate will never exceed the maximum as prescribed by the NCA of 27.75%. Fees subject to change based on risk profile.

Budget Insurance experience and discussion

Budget Insurance experiences

Tell us your experience with Budget Insurance at info@coolfinance.co.za and we will publish it anonymously into our discussion.

Is Budget Insurance a scam?

No. The product is absolutely fine and no need to worry about anything hidden. The company Budget Insurance Company Ltd. really provides these loans.

Lincoln Ndirangu(LinkedIn)

Lincoln Ndirangu(LinkedIn)Lincoln Ndirangu is a professional freelance web copywriter based in Nairobi, Kenya. For over 7 years, writing for the web and engaging the online audience has been primary focus and passion.More information...